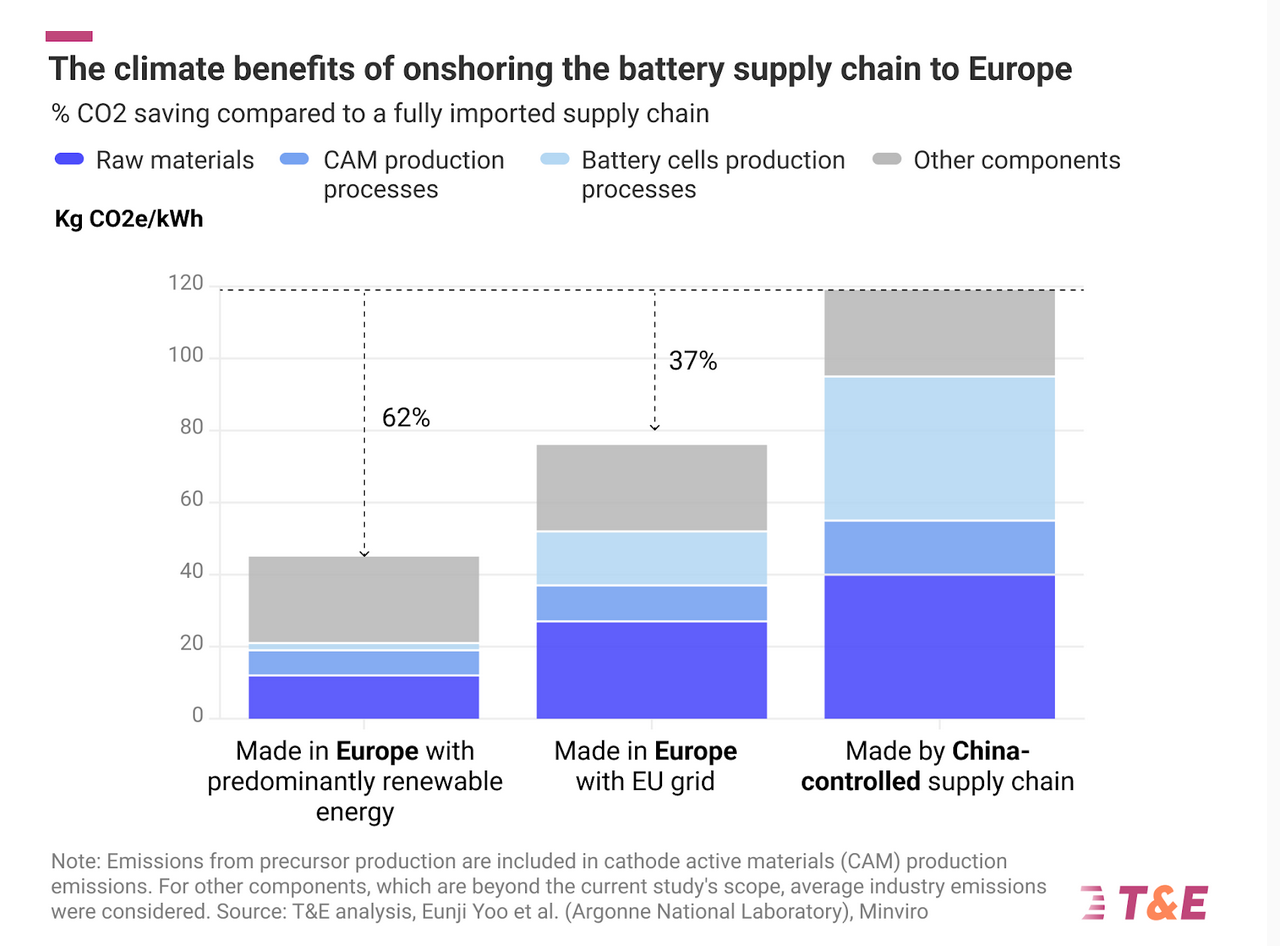

T&E: ‘EU made batteries up to 60% less carbon intensive than Chinese’

According to the NGO Transport & Environment, producing batteries in Europe could be up to 60% ‘cleaner’ than having them made in China /T&E

According to a new analysis by Transport & Environment (T&E), onshoring the EV supply chain to Europe would cut the emissions of pro

Comments

Ready to join the conversation?

You must be an active subscriber to leave a comment.

Subscribe Today